Misled. Overcharged. Ignored. You’re not alone. We’ve seen it all.

There are good ones. There are bad ones. And the bad ones keep evolving.

If you’ve worked with a broker before and felt misled, pressured, or ignored, you’re not imagining it. These aren’t rare stories. They’re how the industry operates far too often. And while it makes us look great by comparison, we still hate to see it.

We're not here to scare you. We're here to help you see it coming.

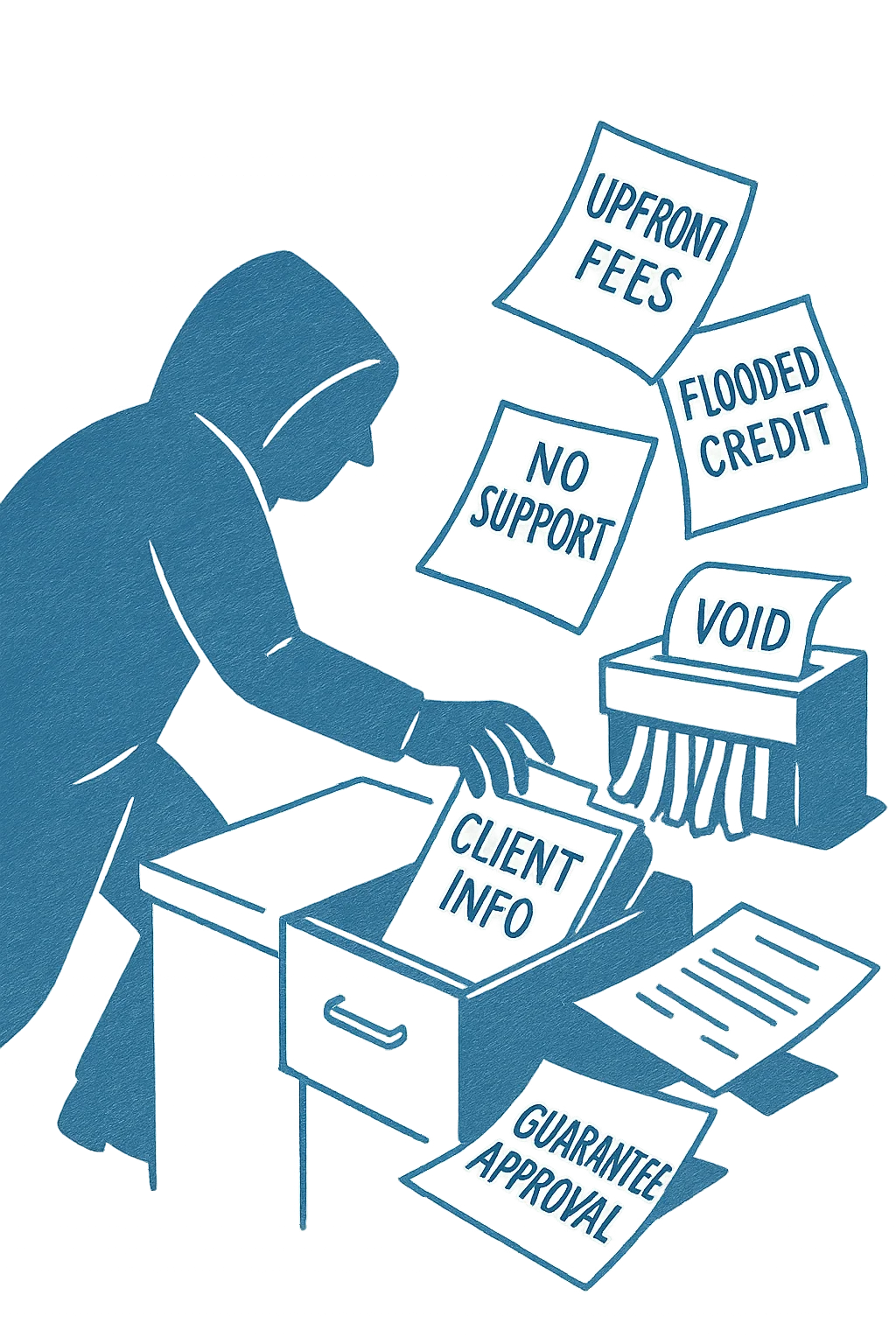

You know their story. Low rates. Fast money. Guaranteed offers. Here’s what’s actually going on:

These aren’t one-offs. They’re the playbook. Built to benefit the broker, not the business owner.

In a perfect world, you'd apply once to the right funding source, get matched instantly to the right product, and move forward right away. But that’s not how business lending works. There are dozens of funding types, hundreds of lenders, and a maze of underwriting traps to avoid.

That’s how a real funding expert earns your business:

That’s what a real funding partner does. And in this industry, it’s rare, and getting rarer.

We don’t do sales scripts. We don’t chase quotas. No one here is calling you five times an hour hoping to wear you down.

Want to talk it through? Great. Prefer to handle everything online? That works too. We adapt to how you operate, not the other way around.

Once we understand what you’re trying to accomplish, we’ll guide you through your real options. No pressure. Just fast timelines, and clean execution.

We’re here to get you funded on the best terms you qualify for.

We’ve worked with business owners burned by every trick in the book. And they’re right to be cautious.

But here's the difference: we don’t just know how the system works. We know how to navigate it with integrity. We’ve built our process to do exactly that.

We’re licensed by the California DFPI and registered with the NMLS. We don't cut corners. We raise the bar.

If you’re skeptical, we welcome that. We're looking forward to showing you why QuicLoans is more than the partner you've been looking for. We're the partner you deserve.

If your business is doing real numbers, you deserve more than promises. You deserve clarity. You deserve speed. And you deserve someone who cares about your outcome.

That’s what we do here. We’re not here to push. We’re here to partner. If you’re ready to have that conversation, we’re ready to lead it.

Apply Now

Fast, clear answers. No pressure. Just results.

In Business

To SMB's

Funded across the U.S.

Find out in 30 seconds. No credit check required.

Answers about speed, requirements, and how funding really works.

Common red flags include upfront fees before funding, guaranteed approval claims, pressure to sign quickly, vague loan terms, and lack of post-funding support. Reputable brokers should clearly explain loan structures and terms before committing.

Direct lenders offer their own specific loan products, while brokers act as intermediaries connecting applicants to multiple lenders. Brokers may offer more options, but direct lenders typically maintain more control over their own loan terms.

Yes, if an application is submitted to numerous lenders without the owner's explicit consent, it can trigger multiple hard inquiries and negatively impact the credit score. Ethical providers should clearly explain their inquiry process.

Some brokers advertise very low rates or high approval amounts primarily to generate sales leads, often presenting different terms later. It is essential to verify rate ranges and final qualification requirements before providing detailed financial information.

Reputable funding partners provide clear explanations of loan terms, disclose fees upfront, answer questions thoroughly without pressuring quick decisions, and maintain transparency throughout the process.

Solve the problems you're facing.

Understand what “Funding in hours” really means, and how we move fast without the sacrifices.

Learn more →We’ve approved thousands of apps from people just like you. See what we can, and cannot, do.

Learn more →Worried about putting your home or business assets at risk? Nothing to worry about.

Learn more →